We believe in rule based investing

We consider digital assets a matured asset class

We actively trade to outperform the crypto market on a risk-adjusted basis

Who we are

We are a team of investment professionals from VLG Capital group. Decades of experience in trading and asset management on the traditional financial markets carved our risk management approach. Our quant research team shapes the core of the rule based investment philosophy we advocate for. Working together makes our investment strategy innovative and efficient.

We are a team of investment professionals from VLG Capital group. Decades of experience in trading and asset management on the traditional financial markets carved our risk management approach. Our quant research team shapes the core of the rule based investment philosophy we advocate for. Working together makes our investment strategy innovative and efficient.

What we do

We provide asset management service to our clients by managing their accounts on the Binance exchange. Each account is managed in line with our VLG Long Short strategy. It has been proprietary developed then stress-tested and traded with our capital and only after is it offered to our clients.

Who we are

We are a team of investment professionals from VLG Capital group. Decades of experience in trading and asset management on the traditional financial markets carved our risk management approach. Our quant research team shapes the core of the rule based investment philosophy we advocate for. Working together makes our investment strategy innovative and efficient.

What we do

We provide asset management service to our clients by managing their accounts on the Binance exchange. Each account is managed in line with our VLG Long Short strategy. It has been proprietary developed then stress-tested and traded with our capital and only after is it offered to our clients.

Strategy

We manage the capital using proprietary developed directional long short investment strategy. It seeks to capitalize on mid to long-term trends on the crypto market. The strategy has trend following principle in its core. We trade Bitcoin and Ether only. The strategy is rule based and is fully automated.

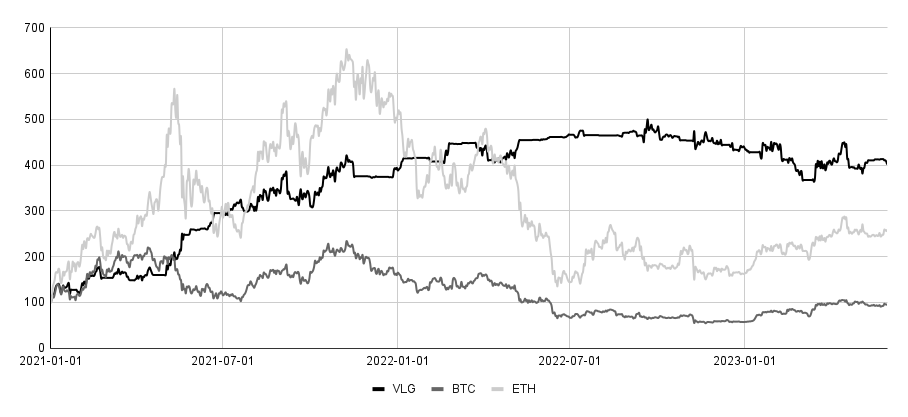

Growth of 100 USD Since Inception*

*VLG strategy was launched on 2021-01-01. If not stated otherwise the performance is measured from the inception date to the end of the last calendar month. Performance figures are net of all fees

BTC

-64.2%

64.5%

-76.6%

neg.

-5.9%

VLG

11.9%

-9.0%

-27.3%

1.34

301.3%

Performance 2022

Performance YTD

Max drawdown

Sharpe Ratio

Total return

Performance Metrics*

Venture Capital

We are looking to allocate our capital to blockchain related projects in their early stage. We focus on the infrastructure, Layer 1/2 and NFT projects as well as UI-friendly decentralized applications. Being proactive as an investor, we are looking to add value to our portfolio companies through our business and investment expertise.